UPU Delivered Duty Paid (DDP) is a product:

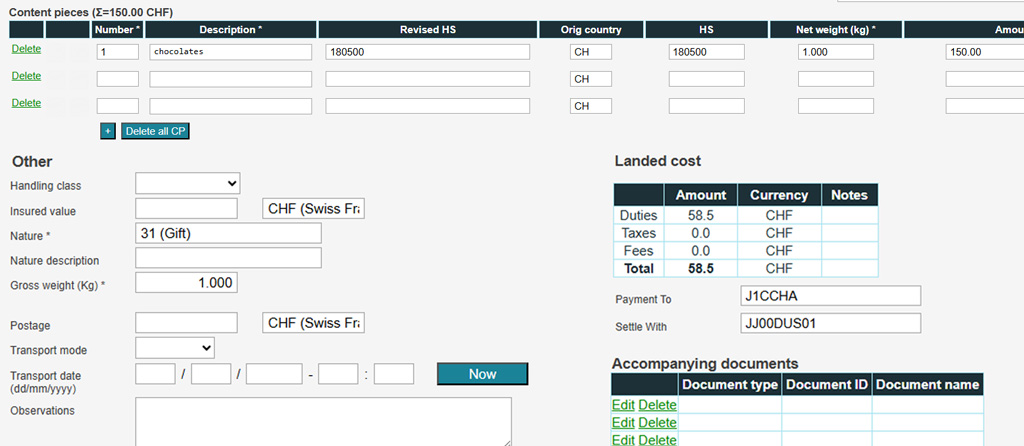

- • for the shipping of goods

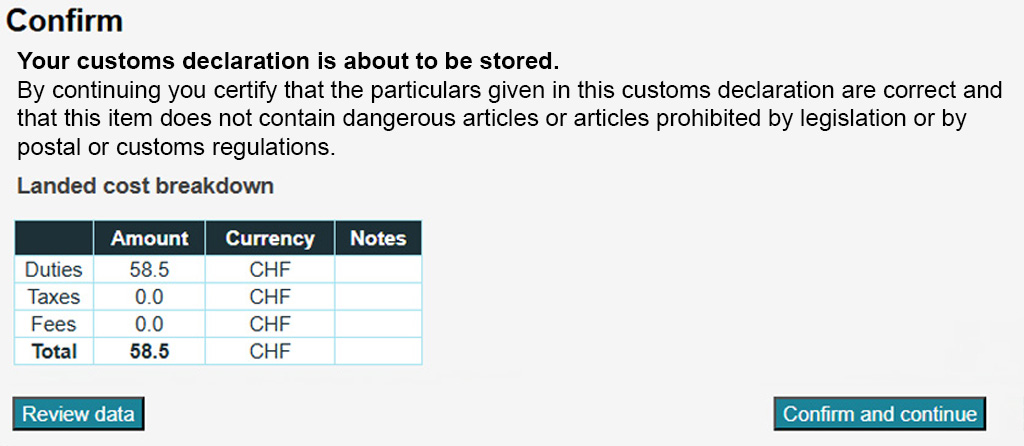

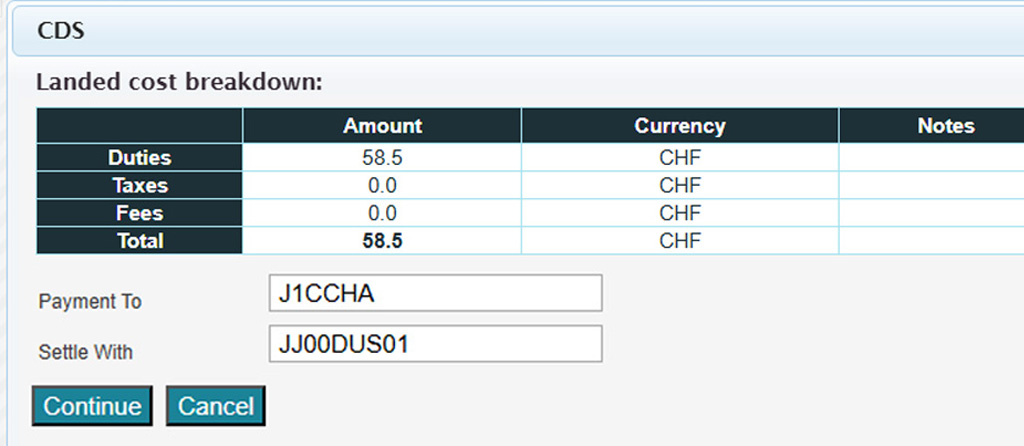

- • that are subject to taxes and duties at destination

- • and for which the taxes and duties are collected at origin (before shipment).

DDP (an international commercial term, or Incoterm) is particularly suited to e‑commerce shipments by Posts. It is designed to accelerate customs clearance at destination and, for a customer buying online, DDP means that all relevant information (full shipping costs including postal delivery and taxes and duties) is available at the time of purchase.

However, DDP entails additional tasks and responsibilities for the origin Post. Specifically, the origin Post must inform the shipper of the applicable taxes and duties, collect the corresponding amounts and transfer these amounts to the customs authority at destination.